Education, Hard Work Won’t Bridge America’s Racial Wealth Gap: Report

By Brian E. Muhammad -Contributing Writer- | Last updated: Mar 22, 2017 - 9:53:59 AMWhat's your opinion on this article?

|

Studies show that the racial wealth gap between Whites, Blacks and Latinos will linger and continue to undermine Black wealth growth. Experts estimate it will take centuries for the wealth gap to close and some advocates say self-determination and doing for self are critical for Black economic success and wealth building.

A recent study published by DEMOS, a public policy organization titled, “The Asset Value of Whiteness: Understanding the Racial Wealth Gap” says that White privilege still outweighs the adage that getting ahead for Blacks and Latinos only requires a good education, a good paying job, and working twice as hard as everyone else.

Nothing is further from the truth, says the report.

“In effect, to gain wealth comparable to White high school dropouts, Black and Latino students must not only complete high school, but also attend college,” said the report authors.

“This report is not unlike many of the previous reports that have come out about the state of Black people,” said James Clingman, the author of “Black Dollars Matter! Teach Your Dollars How to Make More Sense.”

“We are at the bottom of every good category and at the top of every bad one,” he said.

Mr. Clingman who lectures and writes on business and wealth empowerment told The Final Call the solution is self-determination.

A joint report from the Center for Enterprise Development and the Institute for Policy Studies says at the current rate of wealth accumulation it will take Blacks 228 years to close the wealth gap with Whites. Latinos are projected to take 84 years, said the report. The center helps low to moderate income people achieve financial security, contribute to an opportunity economy and build wealth.

Analyzing all three groups between 1983 and 2013, it said the average wealth of White families increased 84 percent or 1.2 times the growth rate for Latinos and three times the rate for Blacks.

If the trend repeats itself over the next 30 years, the average wealth of White households will increase more than $18,000 per year. Meanwhile, Latino and Black households would only grow $2,250 and $750 per year respectively.

“If that’s not a graphic enough illustration about the state that we’re in, I don’t know what is,” remarked Mr. Clingman. “Once you know better you supposed to do better, or (it’s) no better for you.”

While the reports show the depth of conditions caused by systematic racism and oppression, Blacks can turn it around.

|

He has pointed to self-determination, changing destructive lifestyle habits and starting younger generations with productive economic lessons.

With economics, “there has to be a moral component to help us with an Economic Plan,” he said, echoing words of his teacher, the most Honorable Elijah Muhammad.

“We must start teaching the babies, and begin to regenerate a culture of purposeful saving and investing,” the Minister has said.

“This is what Jewish people teach their children. ... Indians from the subcontinent of India teach their children. … Chinese and the Koreans, and others, teach their children,” he said.

Minister Farrakhan said Blacks fail to “analyze and follow the successful models and strategic examples” other ethnic groups follow to benefit their own people.

The recent research shows education is not enough for Blacks and Latinos to realize the wealth levels of Whites.

“When it comes to wealth, white privilege is equally, if not more valuable,” said The Asset Value of Whiteness report.

The study debunks notions that personal choices alone caused the gap.

Research probing the causes traced its origins to deliberate historic injustices, from slavery to segregation to redlining.

“The great expansion of wealth in the years after World War II was fueled by public policies such as the GI Bill, which mostly helped white veterans attend college and purchase homes with guaranteed mortgages, building the foundations of an American middle class that largely excluded people of color,” the report stated.

These past injustices were reinforced as wealth was handed down across generations. Most popular explanations for racial economic inequality overlook these deep-rooted reasons.

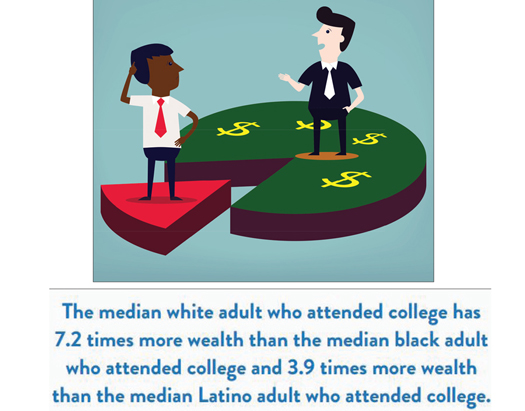

Views associating attending college with wealth and a means for social mobility became popular assumptions. However, the different outcomes for Whites compared with Blacks and Latinos tells the story.

White graduates earning a bachelor’s degree or other college certification are more likely to be employed and generally have higher earning power than high school graduates or dropouts. They can use their higher incomes to build savings and wealth.

The research found that Black and Latino households with at least some college education and gaining a degree had little effect on reducing the racial wealth gap—largely because of the high price tag of college.

Black students borrow at much higher rates and amounts to receive the same college degrees as Whites. Difficulty in maintaining the heavy cost contributes to higher college dropout rates.

The subsequent debt involved interferes with the level of wealth building among Blacks and Latinos compared to Whites. If all things were equal “the reduction in the racial wealth gap would be modest,” says the report—cut only by one to three percent.

With less student loan debt to pay off during working years, the typical White college graduate has a head start on building wealth compared to Blacks. For Latinos, who attend and graduate from college at lower rates than both Blacks and Whites, the outlook is different.

Studies suggests Latino students may be more averse to taking on student loans even when they face substantial financial need for school.

With White hardliners running the U.S. government, Mr. Clingman sees an “opportunity” and a “challenge.” “This is probably the slap upside the head that we need; at least I hope it is,” he said.

INSIDE STORIES AND REVIEWS

-

-

About Harriett ... and the Negro Hollywood Road Show

By Rabiah Muhammad, Guest Columnist » Full Story -

Skepticism greets Jay-Z, NFL talk of inspiring change

By Bryan 18X Crawford and Richard B. Muhammad The Final Call Newspaper @TheFinalCall » Full Story -

The painful problem of Black girls and suicide

By Charlene Muhammad -National Correspondent- » Full Story -

Exploitation of Innocence - Report: Perceptions, policies hurting Black girls

By Charlene Muhammad -National Correspondent- » Full Story -

Big Ballin: Big ideas fuel a father’s Big Baller Brand and brash business sense

By Bryan Crawford -Contributing Writer- » Full Story

Click Here Stay Connected!

Click Here Stay Connected!